Cfd trading account

Range of tradeable instruments: IG offers forex, CFDs, exchange-traded turbos, options, and futures, alongside other derivatives, including over-the-counter (OTC) options, across its global entities and brands (product offering may vary based on your country of residence) Versus Trade. A true multi-asset broker, IG offers a staggering selection of CFDs that spans global markets and various asset classes.

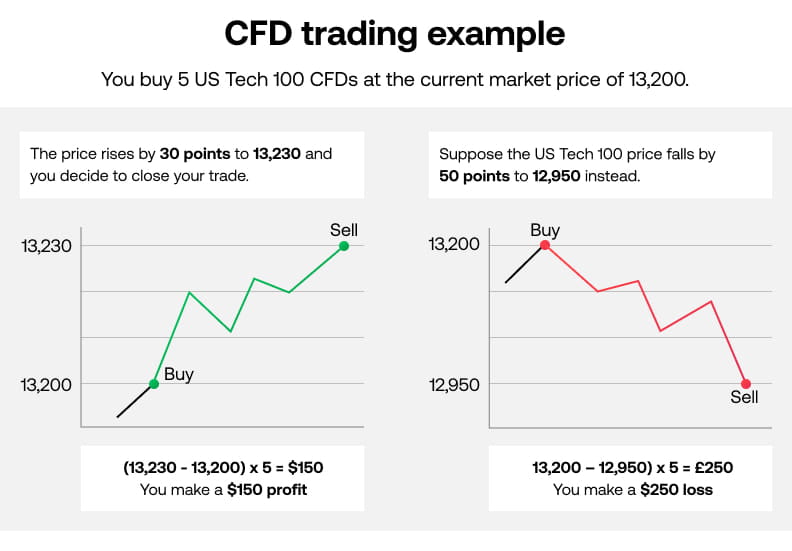

CFD stands for “contract for difference.” It’s an agreement between you and your broker to measure the difference between the value of an asset when a position is opened vs. when it is closed. No physical assets are exchanged, allowing for increased execution speeds and lower costs.

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

TSG is an introducing broker, and it relies on IBKR to execute user trades and hold their positions. While this doesn’t hurt it – IBKR provides some of the best execution speeds of any CFD broker – it also doesn’t set it apart from IBKR. From trade fees to available CFD products, IBKR wins on most counts. IBKR clients can also use TradeStation’s platform.

Cfd trading malaysia

Convenience: You can trade CFDs in many different assets without taking physical delivery, saving on storage, security and transportation costs. For example, you can trade CFDs in gold online and simply profit from price changes in the commodity without worrying about how you will store it securely.

Leverage for Malaysian traders when trading forex, metals, and energies is up to 500:1; however, leverage balancing applies depending on trade size. This is to protect your account balance, as leverage is a risky instrument and no negative balance protection is provided.

Eightcap provides a range of MetaTrader platform plugins from FX Blue Labs, which enhance its standard suite. It also supports integration with Capitalise.ai, a third-party platform allowing algorithmic trading within your MT4/5 account without requiring programming or coding experience.

Swing trading is a strategy that aims to identify changes in the momentum of an asset. When a stock, for example, rebounds from a recent low, swing traders will buy that stock and profit while it has high upward momentum right after the bounce.

The broker offers a desktop version of MetaTrader that supports algorithmic trading, and the cTrader suite includes trading applications such as cAlgo for automated trading and cTrader Copy for social copy trading.

Cfd trading platform

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. DayTrading.com may receive compensation from the brands or services mentioned on this website.

In most cases, this is capped at 1:30 on major currency pairs, 1:20 on minors/exotics and gold, and less on other asset classes. All CFD trading markets at eToro also give you the option of going long and short. This allows you to profit from both rising and falling markets.

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

In terms of getting started, opening an account, uploading ID, and making a deposit usually take less than 10 minutes. You can choose from several popular payment types – including debit/credit cards, bank transfers, and e-wallets such as Paypal and Skrill. Finally, eToro is regulated by the FCA (UK), ASIC (Australia), and CySEC (Cyprus).

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. DayTrading.com may receive compensation from the brands or services mentioned on this website.

In most cases, this is capped at 1:30 on major currency pairs, 1:20 on minors/exotics and gold, and less on other asset classes. All CFD trading markets at eToro also give you the option of going long and short. This allows you to profit from both rising and falling markets.

Bitcoin cfd trading

Yes – You can speculate and hence trade on the rising and falling (Long or Short) of the Bitcoin price by purchasing and trading CFDs (Contracts for Difference). Please note, buying a Bitcoin CFD is not buying the underlying asset of Bitcoin itself, only the contract on the price direction (Buy or Sell).

CFD traders who believe that the price of Bitcoin will increase in the future take a long position, whereas those who believe that the price will decrease take a short position. A CFD broker then manages the buy and sell instructions sent by you, the trader, and facilitates the entire process, by providing an online platform to easily trade CFDs.

Ultimately, if you purchase a Bitcoin CFD, since you do not own the underlying Bitcoin asset, you can’t pay or transfer your Bitcoin CFD to anyone. You’ll only be able to sell that CFD back to the broker and take your profit or cut your losses. This is why it would make sense to understand the difference between crypto CFDs and crypto assets.

Depicted: Admirals MetaTrader 5 WebTrader, BTCUSD M5 Chart. Date Range: April 7, 2022. Accessed: April 7, 2022 – Please note: Past performance is not a reliable indicator of future results or future performance.

CFDs allow traders to capitalise on the price movement of a commodity, such as Bitcoin, without having to actually purchase the said commodity. At its most basic, a CFD is a bet between a buyer and a seller about the future price of an underlying asset.